Payroll penalty calculator

If you receive a tax notice and send it to us within 15-days of the tax notice we will cover the payroll tax penalty up to 25000. Payroll Payroll services and support to keep you compliant.

Excel Formula Calculate Number Of Hours Between Two Times Exceljet

COVID-19 Interest and Penalty Relief Application.

. Call North Florida Payroll Services to Start Saving Time AND Money. Then enter the employees gross. The failure-to-file penalty is usually five percent of the tax owed for each month or part of a month that your return is late up to a maximum of 25.

Heres the information youll need for your calculations. 2022 than you did in 2021 or end up. Additionally IRS Notice 2020-65 allows employers to defer.

2022 tax refund calculator with Federal tax medicare and social security tax allowances. Clients of GTM Payroll Services will find a letter in their online portal that can be used for Dependent Care FSA reimbursements. The provided calculations do not constitute financial tax or legal advice.

In the US federal income taxes are a pay-as-you-go system. If your return is over 60 days late theres also a minimum penalty for late filing. Quarterly Contribution Return and Report of Wages Continuation DE 9C Employer of Household Workers Annual Payroll Tax Return DE 3HW.

Land held on trust Land held on trust Menu. Most full-service payroll software includes a tax-penalty guarantee or a guarantee that if the software company makes a mistake with your taxes it will pay all associated fines and deal with IRS-imposed penalties from the IRS. This CRA interest calculator can be used by tax attorneys accountants or CPAs and individuals or businesses to provide estimates of CRA interest on tax debt.

If you havent filed all your required returns you wont have many options until you file them all. Small business tax prep File yourself or with a small business certified tax professional. Contact the UI Tax Division.

It offers a range-based salary. The following tax returns wage reports and payroll tax deposit coupons are no longer available in paper. The IRS charges or assesses a steep penalty for filing late.

If you expect to earn about the same amount as last year you can take the amount of tax you paid on your 2021 return and divide it by four to figure out your 2022 quarterly estimated tax amount. Payroll period details including the frequency of your pay periods weekly biweekly or monthly and the amount of time for that particular period. As long as your payroll information is submitted accurately and your account is properly funded we guarantee you no payroll tax penalties.

To avoid the IRS underpayment penalty you can choose between the following approaches. 2021 UI Tax Relief fact sheet. 2022-23 Trust Land Tax Rate Calculator.

UI Trust Fund fact sheet. In 2020 an executive memo was released allowing employers to defer payroll taxes for employees. Payroll for QuickBooks Desktop.

Interest and penalty tax. Sample Penalty Relief Letter. Additional conditions and restrictions apply.

Add that to the penalty for paying late and. This means the IRS requires you to pay estimated taxes throughout the yeareither via withholding from paychecks or by making. Yearly Federal Tax Calculator 202223.

No Payroll Tax Penalty Guarantee. Land held on trust up to 2019-20. The 72t Early Distribution Illustration helps you explore your options for taking IRA distributions before you reach 59½ without incurring the IRS 10 early distribution penalty.

If you use this method but end up earning more money in. Delaying or not filing at all is a bad strategy. Save Time and Money - Call Today.

Employers who chose to defer deposits of their share of Social Security tax were required to pay 50 of the eligible deferred amount by December 31 2021 and the remaining amount by December 31 2022. Analyze Pre-Retirement IRA Distribution Options With Our 72t Calculator 72t early distribution analysis. Youll need to gather information from payroll to calculate employee withholding tax.

Quarterly Contribution Return and Report of Wages DE 9. Top Payroll Solutions for Efficient Payroll Management 1. With the right payroll calculator or payroll software you and the IRS can get on the same page and stay there.

Bookkeeping Let a professional handle your small business books. Payroll Tax Act 2009. Its the lesser of 435 for tax returns required to be filed in 2022 or 100 percent of the tax owed.

More Payroll Tax Resources. If you are a GTM client and need assistance call us at 800 929-9213 or email email protected. UI Trust Fund and Payroll Taxes FAQ.

Recommends that taxpayers consult with a tax. Now that you know how payroll management processing works lets look at the top payroll solution that can streamline the entire process. Penalty on early withdrawal of savings Alimony paid b Recipients SSN IRA deduction Student loan interest deduction Tuition and fees.

To try it out enter the employees name and location into our free online payroll calculator and select the salary pay type option. Employer of Household Workers Quarterly Report of Wages and. Online Payroll Reporting System.

2021 Tax Rates and breakdown of changes for Oregon employers. Only QuickBooks Online Payroll Elite users are eligible to. Resolving a tax dispute with RevenueSA.

They also have access to their payroll register as proof of payments. General Oregon payroll tax rate information. Keka is one of the best payroll management systems that is set to revolutionize the Indian payroll industry.

Calculate Bonus In Excel Using If Function Youtube

Payroll Category Ca

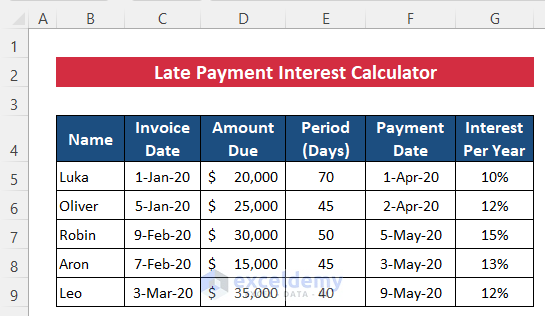

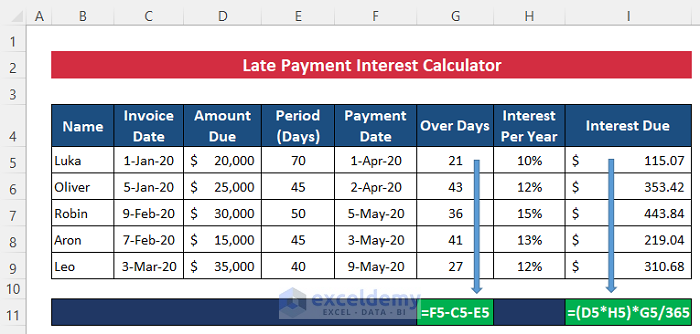

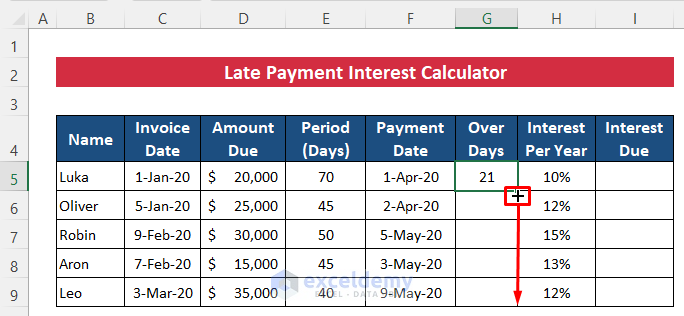

Create Late Payment Interest Calculator In Excel And Download For Free

Late Coming Format In Excel Excel Format Education

What Are The Required Payroll Deductions In Ontario Filing Taxes

Create Late Payment Interest Calculator In Excel And Download For Free

Create Late Payment Interest Calculator In Excel And Download For Free

Excel Timesheet Calculator Template For 2022 Free Download

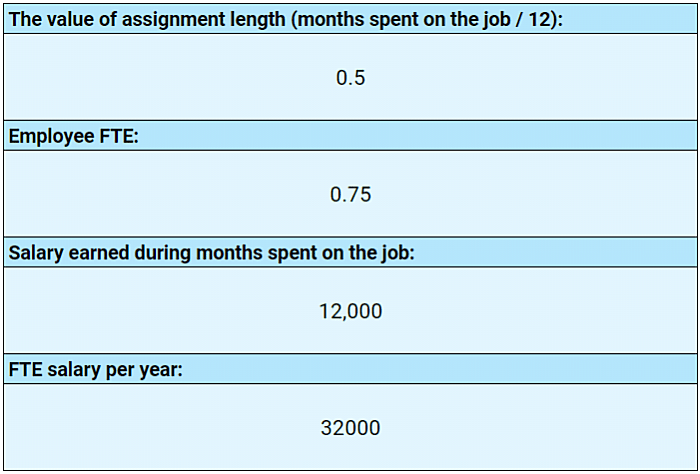

What Is Full Time Equivalent And How To Calculate It Free Fte Calculators Clockify Blog

All Microsoft Excel Templates Free To Download Free For Commercial Use Excel Templates Interest Calculator Credit Card Interest

Calculate The Consequences Of Late Payments On Your Business

The Trial Balance Trial Balance Accounting Basics Accounting

Petty Cash Reconciliation Form Template Reconciliation Business Template Excel Templates

Excel Timesheet Calculator Template For 2022 Free Download

Hourly Rate Calculator The Filmmaker S Production Bible

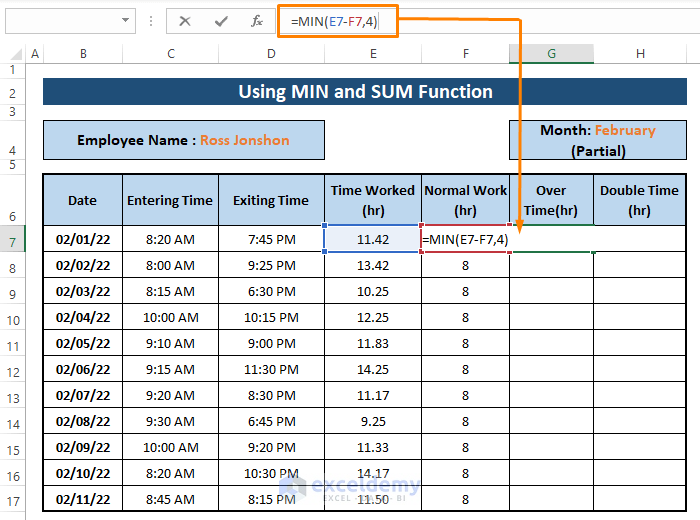

Excel Formula To Calculate Overtime And Double Time 3 Ways

Stock Market And Financial Analysis In Flat Style Stock Market Analysis Stock Market Png And Vector With Transparent Background For Free Download Financial Analysis Stock Market Stock Market Trends